Robust accounting software is a business necessity. From processing payroll and managing invoices to tracking expenses and filing VAT returns, accounting software like Sage keeps your financial records organised.

Despite its central role, many business owners delay upgrading their software due to the fear of messing it up. They prefer sticking with the familiar, even if it means missing out on performance improvements. However, the risks of postponing an upgrade far outweigh the potential risks of upgrading. Delaying your Sage accountancy upgrade can lead to data tracking issues, reduced functionality, and even compliance failures.

This guide explains why upgrading your Sage accountancy software is important and reveals how it can enhance productivity in your accountancy operations.

5 Reasons Why Upgrading Your Sage Accountancy Software is Important

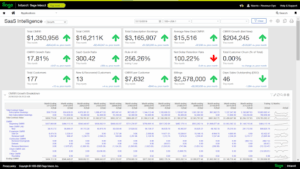

Source: Sage

While the fear of disruption is understandable, the real risk lies in holding onto outdated software that can’t keep pace with your business needs. Here are five reasons why you should upgrade your Sage accountancy software:

1. Difficulty Tracking Data

Older Sage versions can make data tracking slow and frustrating. Without modern automation, bookkeepers often spend hours reconciling accounts and hunting for entries. According to a report by Sage, inconsistencies in invoice data and mismanaged communications with customers and suppliers hinder business operations. It also limits their growth due to reliance on incompatible tools and disconnected systems.

2. Regulatory Compliance

Tax and accounting regulations are frequently updated, and businesses must keep pace to avoid compliance issues. In the UK, Making Tax Digital (MTD) requires the use of compatible software to maintain VAT records and submit VAT returns. Using an outdated or non-compliant version of Sage can lead to failed submissions and potential penalties.

Upgrading your Sage software ensures:

- Your digital records are accurate and well-organised.

- Quarterly submission of income and expense summaries to HMRC.

- Timely and accurate completion of end-of-year tax returns.

3. Limited Reporting

Accurate, real-time data is essential for informed business decisions. Older versions of Sage often rely on rigid, outdated reporting tools, making it difficult to filter, customise, or drill down into key financial metrics. This can slow decision-making and limit visibility into business performance.

However, with an upgrade, you get updates on profits, overdue payments, and customer and supplier activity. It also enables quicker detection and correction of errors or inconsistencies, helping prevent them from escalating into major issues.

4. Bug Fixes

Software bugs can lead to calculation errors, system crashes, and compatibility issues. Sage’s policy is to support only the latest three versions of its products, meaning older versions no longer receive regular patches or fixes. As a result, known issues remain unresolved and may eventually compromise software functionality.

If your Sage software is having problems or you want to avoid potential issues, the only solution is to upgrade your software.

5. Lack of Integration

Accounting requires seamless integration with several tools and software, including CRM platforms, POS, payroll software, and cloud storage. If you have an outdated Sage version, it may lack modern API capabilities. This forces accountants and bookkeepers to manually transfer data, which may waste time and increase the risk of errors.

Benefits of Upgrading Your Sage Software

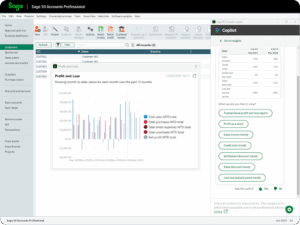

Source: Sage

Each Sage upgrade introduces tools designed to save time, enhance decision-making, and reduce operational costs. By upgrading your Sage accountancy software, you equip your business with the latest features, keeping it ahead of the curve and ready to meet evolving demands.

1. Enhanced Scalability

As your business grows, your accounting needs expand. The latest Sage versions are built to handle increased users, higher transaction volumes, and more complex reporting. Whether you’re adding new departments, onboarding more staff, or managing operations across different locations, upgraded Sage software helps you scale without any problems.

This ensures you don’t have to change your accounting system every few years. Instead, you can continue with the same software that your bookkeepers are familiar with. Just upgrade it as your business expands.

2. Better Customisation

New Sage software allows you to customise your experience through the role-based dashboard. This means you can filter the metrics you see on your dashboard based on your role or relevance.

Additionally, you can customise what’s reported to your employees depending on their roles to improve security by limiting access to sensitive data. As a result, workflow becomes smoother with fewer errors and higher employee satisfaction.

3. Flexible Reporting

Data is only useful if it can be accessed, interpreted, and acted upon quickly. By upgrading your Sage software, you gain real-time financial reporting with advanced filtering and export features. Instead of spending days pulling and reconciling figures from different sources, you can generate comprehensive reports in a few clicks. It allows you to:

- Monitor KPIs instantly.

- Compare performance over long periods.

- Create tailored reports in minutes.

4. Increased Visibility

Updated Sage accountancy software provides improved visibility over your entire financial picture. You can clearly see the project progress, expenses, and profits, and even sort the costs and revenue by project, department, or client.

It allows you to make data-driven decisions, resulting in enhanced productivity and business growth. With secure cloud access, you and your team members can log in from anywhere and access the data safely.

5. Security Enhancement

With cybersecurity threats increasing rapidly, accounting software must be regularly updated to remain secure. Outdated versions of Sage are more vulnerable as they lack the latest security patches and compliance updates. The latest Sage software meets international security standards, holding certifications such as ISO 27001, PCI Security Standards Council compliance, and GDPR adherence.

Take Control of Your Accounting with a Sage Upgrade

Not upgrading your Sage software when it’s due leaves your business exposed to compliance failures, inefficiencies, and security threats. This is because outdated software can’t keep up with evolving legislation, growing transaction volumes, or increased cyber threats.

At Rejuvenate IT, we specialise in making Sage upgrades stress-free. We handle everything, from transferring your data securely to integrating it with your workflow so you can focus on your business. Book our free consultation to improve your performance and have greater visibility over your finances.

FAQs

What is the purpose of Sage accounting software?

Sage accounting software helps simplify financial management and bookkeeping for businesses. It helps you process payroll, automate invoices, track expenses and revenue, and file VAT returns timely, ensuring accuracy and compliance while saving time.

What is the best version of Sage?

The best Sage version depends on your business size and needs. Sage 50 and Sage Business Cloud Accounting work great for small businesses. While Sage 100, 200, 300, and X3, and Sage Intacct are ideal for medium to large companies.

Why upgrade accounting software?

Upgrading accounting software keeps your system compliant with regulatory laws, secure against cyber threats, and equipped with features to improve accuracy and productivity. As your business grows and your needs evolve, your accounting software also needs to change to support your business growth.